Clarida and Williams stir the markets following comments on interest rate cuts

Friday 19th July 2019 saw me wake up to news that two prominent Fed officials had caused a stir within the financial markets after their remarks concerning interest rate cuts.

Clarida, the Fed Vice-Chairman, expressed that “you don’t need to wait until things get so bad to have a dramatic series of rate cuts”. Following this, the New York Fed Chief John Williams remarked “when you only have so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress” (Bloomberg, July 2019). This marked a significant change in Fed communication, suggesting an even more aggressively dovish tone from the Fed than was previously anticipated. The markets reacted in kind. The probability of a 50 basis point cut had jumped from 28% to 48% within the space of a month (CME Group, July 2019).

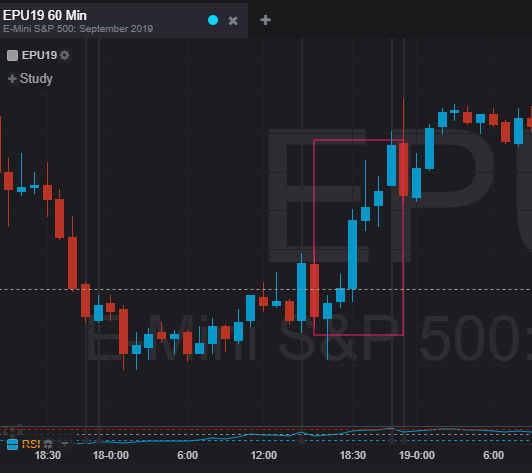

On the back of this apparent more dovish tone from the Fed, S&P 500 futures, gold and EUR/USD all had a big push on the upside and treasury yields fell. However, in each case, the upside movement in prices preceded a drop soon after. This drop was particularly prominent in the case of EUR/USD and US bond prices. So, what was the reason for this?

The answer lies in what followed the remarks made by the key Fed officials. The official New York Fed spokeswoman came out and clarified that Williams’ comments were merely academic and did not constitute an insight into the potential policy action at the upcoming FOMC meeting (xtb, July 2019). In my opinion, the fact that the Fed took the highly unusual step of having the official NY spokeswoman come out with such clarity is telling. It seems that the Fed was trying to communicate that the market had over-positioned itself following the comments, and therefore I believe that a 25 basis point cut is still very much the most likely course of action for the 31st July meeting. In other words, the Fed had made a serious error in their communication. I use the word ‘serious’ for good reason.

The Fed is now facing a problem. As virtually half of the market is expecting a 50 basis point cut, delivery of a 25 basis point cut will most likely see a hawkish reaction in the markets initially despite the policy action being expansionary. Equities, EUR/USD and gold will likely fall and yields may actually spike. Therefore we may see the Fed use forward guidance in the coming days (in the form of other Fed speakers) to realign market expectations before the looming official blackout period is beyond us.