31st July 2019 – Fed cuts rates for first time since 2008

Wednesday 31st July 2019 saw the long-awaited Fed interest rate decision, and it didn’t disappoint…unless you’re Trump of course.

To gauge an understanding of some of the reasons for the market reaction of the decision, we must first look at the market sentiment coming into the meeting. Markets were virtually 100% priced in for a rate cut, the only question was as to whether it would be by 25 or 50 basis points. Minutes from last month’s FOMC meeting indicated that Fed officials saw a stronger case for “somewhat more accommodative policy…”. Powell also recently mentioned the interconnectedness of the US economy with the rest of the world (Financial Times, July 2019) and slowing global growth, as indicated by the recent downgrade by the IMF, suggested a dovish bias for the Fed.

I, along with 76% of the market, believed that a rate cut of 25 basis points would occur, as oppose to 50. The miscommunication by Clarida and Williams (covered in my previous post) had stoked market expectations of a 50 basis point cut before the NY Fed reversed most of this move. Furthermore, sources in the Wall Street Journal stated that Fed officials were not prepared to cut by 50 as recent economic developments did not indicate it was necessary to do so. Several other factors suggested a 25 point cut, such as the rising Citi economic surprise index and the fact that the Fed has never cut 50 without there being a financial crisis. However, markets were priced for multiple rate cuts for this year following this one, therefore the future guidance that accompanied the interest decision was of paramount significance.

At 7pm London time, Powell announced a rate cut of 25 basis points.

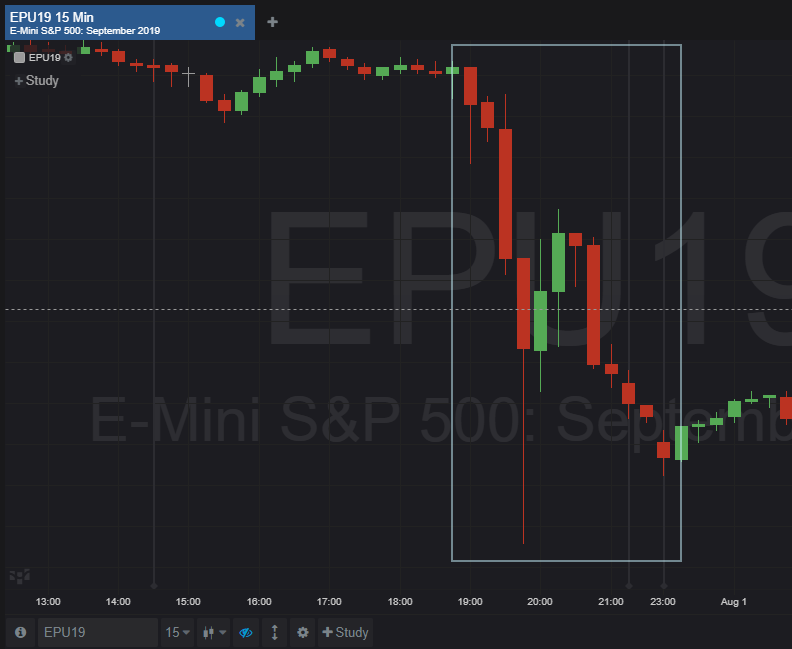

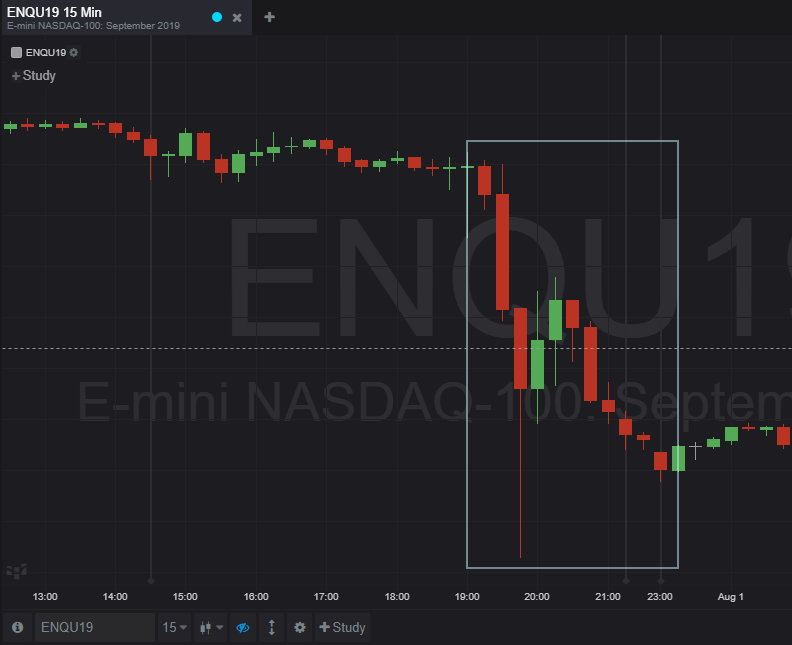

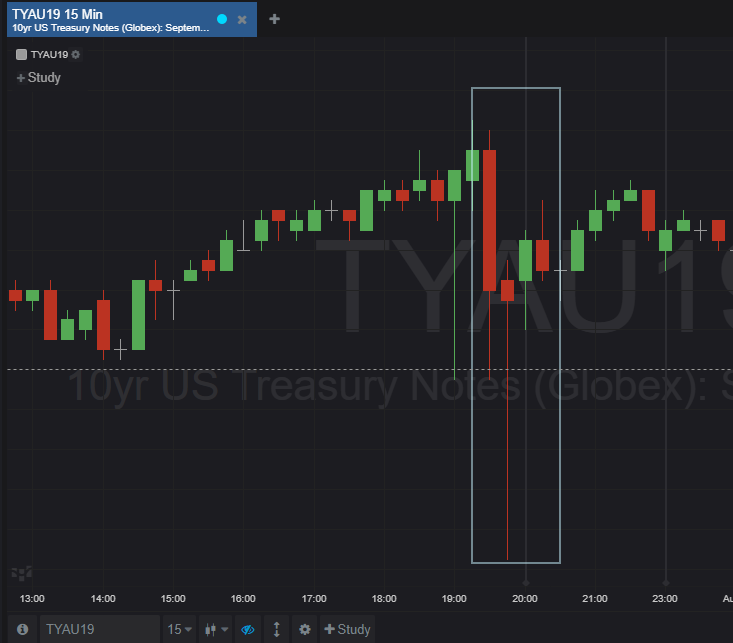

Initially, there was a hawkish reaction as those who had priced in a 50 basis point cut unwound their pricing. Equities and Gold fell sharply as the dollar strengthened and yields rose. There were also two dissenters in the form of Ester George and Eric Rosengren, adding further hawkish stimulus. However, equities and treasuries saw a slight pullback after the initial drop. This was because the Fed had announced that they would be ending quantitative tightening one-month early. This dovish announcement mitigated some of the initial hawkish sentiment.

The markets then waiting on tenterhooks for Jerome Powell’s press-conference and the Fed’s future guidance.

Powell’s press-conference and Q&A session had caught the market by hawkish surprise. He remarked: “We are thinking of it as essentially in the nature of the mid-cycle adjustment to policy” and signaled that the rate cut was not necessarily the beginning of a long easing cycle as well as stating that the outlook for the US economy remains favorable. This indicated that the 25bp cut was perhaps an insurance cut rather than a commitment to subsequent cuts. Powell’s words were perceived as quite hawkish and the markets reacted in kind…

Major equity indices such as the S&P 500, NASDAQ and the Dow Jones fell significantly. The DXY rose and gold fell on the back of a strengthening dollar. The EUR/USD futures fell from 1.11815 pre-decision to a low of 1.10720 the following day.

Some suggest that the Fed got this wrong and that the US is more late-cycle than mid-cycle, and therefore should have taken steps in consideration of this. There is no greater critic of Powell than Mr Trump, who had made no secret his desire for the start of aggressive rate cuts. This strengthening dollar and weakened euro makes Germany more competitive as an exporter, much to the dismay of Donald trump. Furthermore, the decline in the US stock indices would have been sure to further aggravate the president. However, given the largely positive US economic date and the Fed’s limited room for manoeuvure, I believe that Powell has, on the whole, made the right decision.