For a matter of months now, it can be strongly argued that Trump had been playing (reasonably successfully) the puppet-master, keeping the financial markets on strings, dancing to his ever-changing tune.

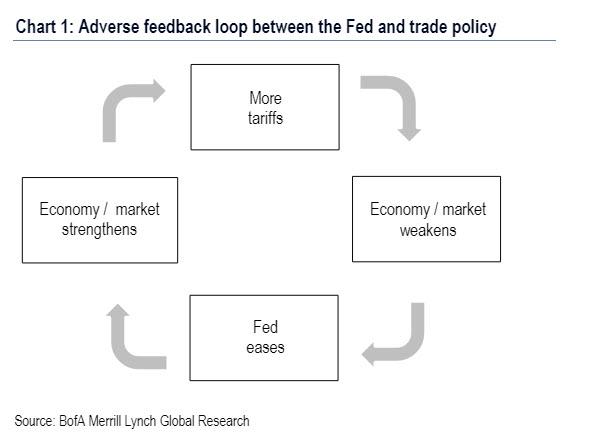

This can be summarised by the adverse feedback loop, seen above. By Trump imposing more tariffs on Chinese goods, the economy weakens as a direct consequence of escalating trade tensions. The Federal Reserve is then seen to have to accelerate policy easing to re-strengthen the markets. Trump is singularly the catalyst for market movement a lot of the time, and this is something he is very much aware of and benefits from. However, is he losing his grip on the situation?

It could be argued that to this point, both America and China had a relatively equal-footing with respect to the trade war, and perhaps America even had the upper hand. Trump aggression was met with Chinese retaliation and Trump de-escalation was met with Chinese de-escalation of the trade tensions. However, it would appear that Trump’s lack of commitment to a single rhetoric and his constant flip-flopping has seen China’s patience finally run thin. Mere days after a hostile Twitter rant which saw the announcement of an additional tariff increase of 5% on imports from China (BBC, August 2019), Trump, while attending the G7 conference in Biarritz, then went on to say that both the US and China had held positive phone conversations and both had a strong willingness to strike a deal. This supposed phone call was actually denied by a representative of Chinese state media. Several Chinese analysts have cited deepening distrust with Trump as a huge obstacle to any immediate trade resolution and that China are no longer taking Trump’s rhetoric seriously; they are now preparing for worst-case scenarios. In my opinion, this is the first time in the Trade War dispute that I see a significant shift in power away from America and onto China. Remember that China had carefully managed their currency and successfully de-sensitised the market to the psychological level of 7 Yuan per Dollar. This has allowed them to weaken their currency in the last couple of weeks without disastrous mass capital outflows.

Furthermore, it would appear than the Federal Reserve are also not on Mr Trump’s side. Bill Dudley, the former head of the New York Fed and former vice-chair of the Federal Reserve, came out with a column that was highly scathing of Trump and suggested that the Federal Reserve act against him in order to dampen his re-election hopes in 2020 (Bloomberg, August 2019). Although he is not a part of the Federal Reserve and the Fed has come out to say that they are independent of politics, there still remains a feeling that the Federal Reserve are not inclined to assist Trump to the best of their ability.

Should both China and the Federal Reserve no longer play ball with Trump, it could spell major problems for the president. It would mean a break in the adverse feedback loop that had previously served the President so well. This would mean that Trump would be forced to soften his stance with the Federal Reserve and China, which may appear as a sign of weakness that would not go down well with some of his supporters in the run-up to the next presidential elections.