Mario Draghi rocks markets in his penultimate interest rate meeting as ECB President

Thursday 12th September saw Mario Draghi cause a stir in the financial markets. Firstly, he announced a 10 basis points cut of the deposit rate, bringing it further into negative territory at -0.5%.

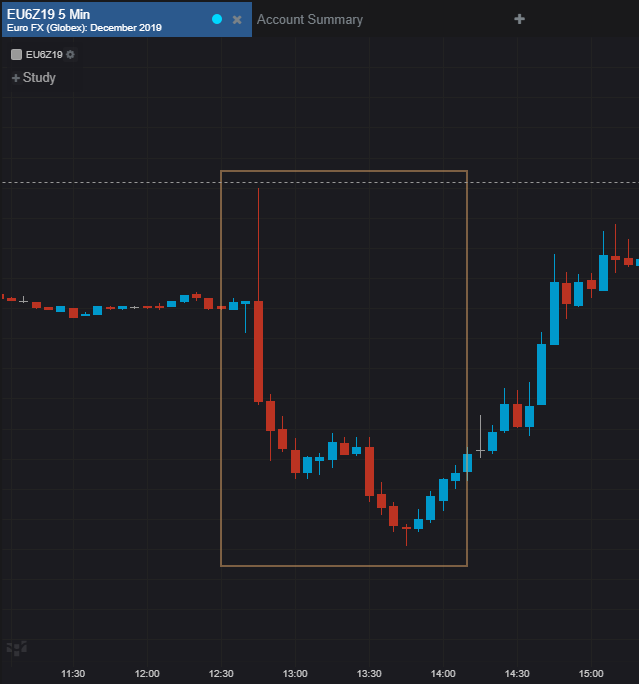

Initially, the market saw this as a slightly hawkish event as those priced in for a 20bp cut unwound their positions. This saw the Euro strengthen significantly. However, this was followed by a major move downwards for the Euro. Why was this?

Well this initial hawkish move was offset by significant accomodative policy. Draghi announced a tiering system that exempts part of banks’ excess liquidity from negative rates (Bloomberg, September 2019). He also scrapped calendar-based future guidance, citing current rates or lower until inflation “robustly” converges on goal. Most significantly of all, Draghi dropped a QE bomb shell. As of 1 November, the ECB is restarting their QE programme at €20 billion per month – but with no set end date! The QE programme will continue until just before the first rate hike! This extremely accomodative policy prompted a typical dovish reaction in the markets, seeing the Euro weaken significantly against the dollar. However, Draghi’s re-introduction of QE was not without its critics.

There was notable acrimony to the re-introduction of QE from some of Europe’s most important members. Germany, Austria, Netherlands, France and Estonia all opposed it. They believe that the action was disproportionate to the economic situation Europe find themselves in. This is particularly worrying given the lack of monetary policy ammunition available to the ECB, especially given that economists are predicting a recession in the coming years. This poses a real challenge for Christine Lagarde as she inherits a Europe divided on the best course of action given the current political landscape.